Advertiser Disclosure

Last update: June 11, 2025

9 minutes read

How Much Money Can You Get Through FAFSA? (The Truth)

Find out how much FAFSA can give you and expert strategies to boost your financial aid package. Learn to plan reporting years, reduce reportable assets, and tap into state and institutional scholarships.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Navigating the FAFSA process can feel overwhelming, but with the right strategy you can maximize every dollar of financial aid available.

In this guide, we’ll answer questions like "How much financial aid can I get?" and clarify "Is fafsa free money or a loan?", then walk you through actionable steps—both on the federal side and beyond.

This helps you plan ahead, reduce your expected contribution, and tap into state and institutional scholarships. By the end, you’ll have a clear roadmap for boosting your aid package and closing the gap on college costs.

Key takeaways

- FAFSA is a federal form to apply for student financial aid, including grants and loans

- The total amount independent undergraduates can get through is $57,500 in loans, with grants amounting to a little more than $10k annually (if you qualify)

- The financial aid amount is influenced by factors like Cost of Attendance (COA) and Expected Family Contribution (EFC)

What is the most FAFSA money you can get?

The maximum amount of aggregate loans that independent undergraduates can get through FAFSA is $57,500. Interestingly, only up to $23,000 of this total can come in the form of subsidized loans, with the remaining amount being unsubsidized loans.

For grants, you can potentially receive up to $11,395 annually - but it’s rare to qualify for the full amount, and there are some strings attached. Note that maximum loan amounts are a bit lower for undergraduates still considered to be dependents of their parents. These students can take out up to $31,000 in total loans - but the $23,000 subsidized limit remains the same.

What is FAFSA?

Let's start with the basics - the FAFSA, or the Free Application for Federal Student Aid, is a tool that can help you get money for college. It's a form that both current and potential college students can fill out on the official FAFSA website.

Remember, FAFSA isn’t the organization that hands out loans - that role is reserved for the Department of Education. So when you get a “FAFSA” loan, it’s really just a federal loan.

Of course, to qualify for those loans, you’ll need to fill out the FAFSA form. This isn't just a formality. It can determine the amount of financial aid the government can give you with grants and/or loans.

The best part? Applying for the FAFSA is 100% free. Now, let's explore the types of loans you can get:

- Subsidized loans: Interest payments are paid by the Department of Education while you're in school.

- Unsubsidized loans: Interest starts accruing once the loan is given to you, even while you're attending school. However, payments aren’t required until after graduation.

Which factors influence FAFSA aid amounts?

Now that we've introduced FAFSA, let's tackle the question of "How much FAFSA money can I get?". The answer isn't straightforward since there are many factors that influence your FAFSA aid:

- Cost of Attendance (COA): This includes tuition, room and board, cost of books, supplies, and transportation associated with your college.

- Expected Family Contribution (EFC): It's a measure of your family's financial situation, including income, assets, benefits, etc.

TuitionHero Tip

Understanding your COA and EFC is crucial for assessing potential aid and clarifying your college financial situation through FAFSA.

How can I maximize my FAFSA aid?

There's a maximum cap to how much money the government can give you, but it's tied to certain factors. For example, the Federal Pell Grant, targeted at students with high financial needs and no prior degrees, can grant you up to $7,395 annually.

And the best part? You don't have to pay this amount back.

For those who don’t qualify for the Pell Grant, there’s also the Iraq and Afghanistan Service Grant in the same amount, but it’s only for students who lost a parent serving in the US armed forces.

If you plan to become a teacher after graduating, you also might qualify for an extra $4,000 a year in federal TEACH Grants.

So, the total amount of federal grants you might qualify for is $11,395 per year - but it’s rare to get that full amount. In addition to grants, you can receive a total of $57,500 in loans throughout your college education if you’re an independent undergraduate, through a mix of subsidized and unsubsidized loans (that’s $14,375 split up annually).

Remember our limit of $23,000? That's the maximum you can receive in subsidized loans. The remainder will be unsubsidized.

Are private loans a better option?

In simple terms, federal loans are a better option than applying for private loans for your education. Private loans involve a complicated application process, finding a cosigner, and dealing with other challenging details, such as higher interest rates.

Applying for federal loans through the FAFSA is more straightforward and user-friendly. It might cause a bit of stress at first, but in the end, it could be the financial help you need for your college experience. The only caveat is that it may not cover 100% of your tuition needs.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

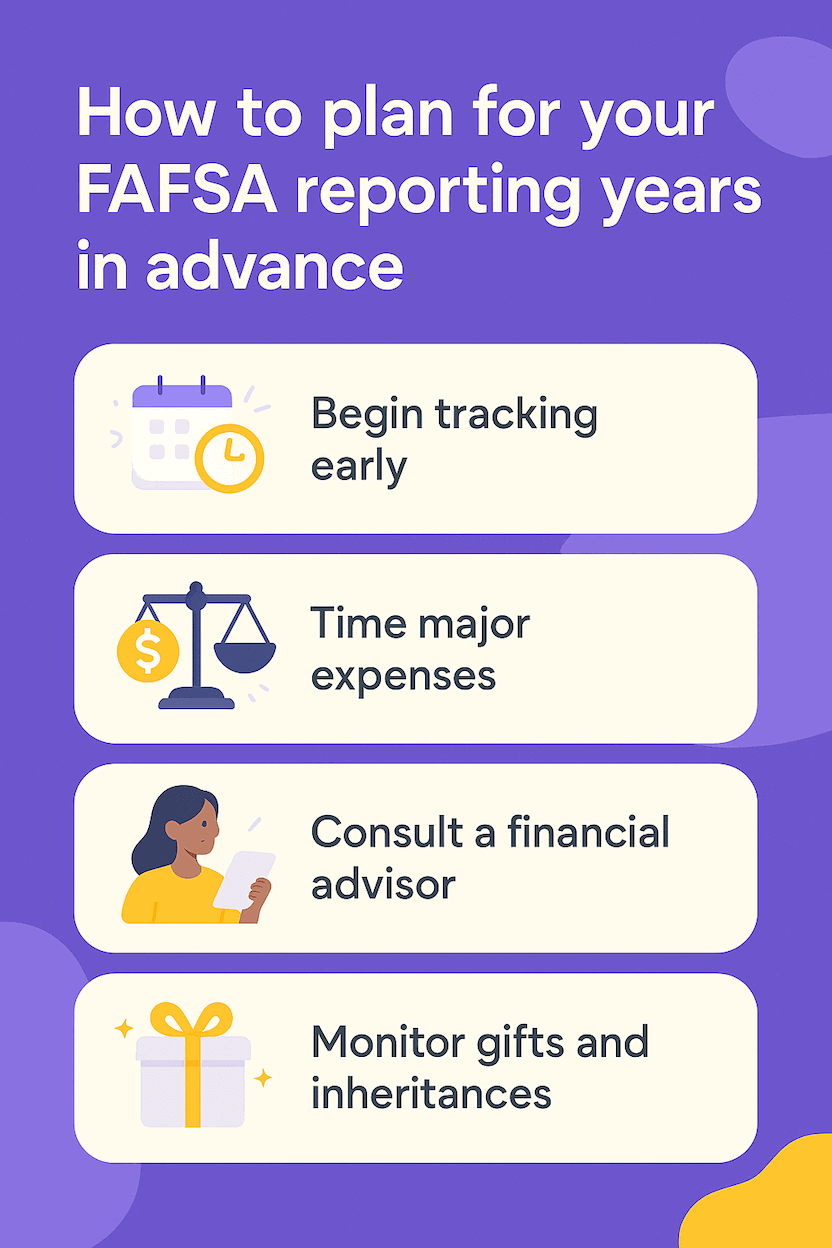

How to plan for your FAFSA reporting years in advance

Early preparation can meaningfully boost your eligibility for need-based aid—and help you understand how much does FAFSA give before you even file. Since the FAFSA reports your financial data from spring of your sophomore year through fall of your junior year in high school, follow these steps:

- Begin tracking early: In freshman year, start saving copies of W-2s, 1099s, and any tax returns you or your parents file.

- Time major expenses: Avoid large withdrawals from retirement accounts or one-off income spikes (like cashing in investments), since does FAFSA give you money based on the average values reported.

- Consult a financial advisor: If you’re considering home improvements, car purchases, or other sizable expenses, ask how the timing could affect how much can you get from FAFSA in need-based aid.

- Monitor gifts and inheritances: Gifts over the IRS annual exclusion limit can be reportable. If possible, stagger or minimize large transfers before the reporting period ends.

Maximizing state and institutional aid

Federal aid is only part of the picture—states and colleges award billions in grants and scholarships every year, on top of what you learn about how much money does FAFSA give.

To tap into these funds:

- Visit your state’s higher-ed website. Note priority deadlines and unique eligibility criteria, then compare that with how much can I get from FAFSA for your COA.

- Use each college’s net price calculator. Many campuses layer institutional grants on top of federal aid; these tools can even show you how much does FAFSA give based on income thresholds.

- Apply early and often. Institutional funds often run out quickly; submitting applications (or scholarship essays) before priority dates can make the difference.

- Research department-specific awards. Academic departments frequently manage their own scholarship pools—reach out to department offices in your intended major.

- Leverage local organizations. Community foundations, civic groups, and local businesses often offer awards that see fewer applicants than national contests.

Dos and don'ts of applying for FAFSA

When applying for the FAFSA, there are certain things you should do and mistakes you definitely want to avoid. These can really affect the amount of aid you receive and, in the end, your financial situation as a college student.

Do

Do complete the FAFSA every year

Do apply as early as possible

Do check your eligibility criteria

Do provide accurate financial information

Don't

Don't assume the FAFSA is a one-time thing

Don't procrastinate, as you might miss deadlines

Don't blindly apply

Don't exaggerate or underestimate your finances

Distribution of college funds

It's important to note that the total amount of FAFSA aid isn't simply handed over in a lump sum. The distribution of college funds is divided into 3 main buckets. Let's take a closer look.

Type | Amount | Must be repaid? |

|---|---|---|

Federal Pell Grant | Up to $7,395 annually | No |

Subsidized Loans | Up to $23,000 | Yes |

Unsubsidized Loans | $34,500 for independent undergrads, $8,000 for dependent undergrads | Yes |

Advantages and disadvantages of FAFSA aid

Understanding college finances can be hard. It's important to consider the advantages and disadvantages, especially when making the big decision to apply for federal aid through the FAFSA.

- You can potentially get free money via grants.

- Subsidized loans offer the advantage of the government paying interest while you're in school.

- You're not burdened with a heavy penalty if you decide to prepay your loan.

- It provides a smoother, simpler process compared to private loans.

- It may take some time to gather your required information. But honestly, that's it, you really don't have much, other than some time, to lose.

2026–27 FAFSA updates: What to expect

The Department of Education is already working on the 2026–27 FAFSA, with a draft of the new form and submission summary open for public comment through April 7, 2025.

Once finalized, the updated FAFSA will go live on October 1, 2025, and will include a simple “Who’s My FAFSA Parent?” wizard to help students accurately identify which parent’s information to report, cutting down on errors and speeding up the aid process.

Why trust TuitionHero

At TuitionHero, we help teach you all about college finances. We offer services like Private Student Loans, Student Loan Refinancing, Scholarships, and even Credit Card Offers.

The process of applying for the FAFSA, understanding eligibility criteria, and estimating the potential aid can be confusing. But don't worry! We're here to guide you through the confusion and break down this process into easy steps. Our mission? To turn your education dreams into reality without drowning you in debt.

Frequently asked questions (FAQ)

The earlier, the better! The 2024-2025 FAFSA applications opened in December 2023. We recommend you apply as soon as possible to make sure you don’t miss any deadlines.

Yes, it can. Your FAFSA award amount can change each year based on many factors including your family's financial situation, the number of family members in college, and the policy of your school or state.

Absolutely! FAFSA isn't only for undergraduates; it also covers graduate studies. However, this financial aid works a bit differently. You can often qualify for higher loan amounts, but usually, they are unsubsidized.

Unfortunately, no. Federal aid is mainly intended for U.S. citizens, certain eligible non-citizens, and U.S. nationals. If you're an international student, you might want to explore other options, like scholarships or private international student loans available on our TuitionHero platform.

FAFSA itself is an application to federal student aid programs—it doesn’t directly hand out funds. The largest single federal grant is the Pell Grant, which for the 2025–26 award year tops out at $7,395.

Beyond that, your total federal aid package—grants, loans, and work-study—cannot exceed your school’s cost of attendance (COA), which varies by institution.

- File early: FAFSA opens October 1—many need-based awards run out on a first-come, first-served basis.

- Reduce reportable assets: Move savings into retirement accounts or HSAs and pay down debts before filing.

- Appeal for more aid: Submit a professional-judgment appeal if your family has unusual circumstances (job loss, medical expenses).

- Pursue state and institutional aid: Research your state’s priority deadlines and use each college’s net price calculator to identify additional grants and scholarships.

Final thoughts

Securing college funding is a multi-step process that extends well beyond filling out the FAFSA form.

If you want to learn how to get the most money from FAFSA, start by planning your reporting years, minimizing reportable assets, and aggressively pursuing state and institutional awards.

Doing so will ensure you understand how much does FAFSA cover and can build a financial aid package that significantly lowers your out-of-pocket costs. Start early, stay organized, and explore every opportunity—your future self (and your wallet) will thank you.

Source

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates