Advertiser Disclosure

Last update: June 6, 2025

5 minutes read

Wells Fargo Exits Student Loans

Learn what happens to your Wells Fargo student loans now serviced by Firstmark under Nelnet. Get step-by-step prep tips, refinancing insights, and top federal-loan alternatives.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Change is never fun—especially when it comes to your student loans. With Wells Fargo student loan portfolio now in Firstmark Services under the Nelnet umbrella, you might be wondering what to do next. If you held a Wells Fargo private student loan, your terms stay the same—even as you switch portals.

Below, you’ll find quick steps to prepare for the handoff and a rundown of federal-loan options that could save you money and add flexibility, even if you started with a WellsFargo student loan.

Key takeaways

- Wells Fargo's private student loan portfolio is now serviced by Firstmark Services, but the loan terms have not changed

- Loan recipients are advised to continue payments as usual until they are notified that the transfer has been completed

Wells Fargo exits student loan arena; FirstMark takes the reins

Big change alert! During the pandemic, Wells Fargo said bye-bye to its private student loans.

They passed the baton to Firstmark Services, which is under Nelnet. If Wells Fargo was your go-to for loans, don't worry—your loan terms stay the same with Firstmark. Everything remains the same, except where you send your payments.

Maintaining loans post-transition

If you had a loan with Wells Fargo, don't worry—your money journey stays on track; Firstmark is just taking care of things now. Once you’ve been notified of the changeover, start paying them instead, and your loan terms won't change. Just make sure your payments go to Firstmark after the switch is done - they will reach out to you with the instructions on how to do this.

Preparing for the transition

Before you start sending payments to a new servicer, take these four simple steps to keep your loan on track:

- Gather your account details: Locate your student loan Wells Fargo account number. You’ll need it to register on Firstmark’s portal.

- Pause your old autopay: If you’ve enrolled in autopay, cancel it once you see your final Wells Fargo draft. You don’t want payments sent to the wrong place.

- Verify your contact info: Confirm that Firstmark has your updated mailing address and email. They’ll send your welcome packet—and you don’t want it going to last year’s dorm room!

- Watch for transfer notices: Firstmark will mail or email you instructions within 30 days of your Wells Fargo student loans transfer. Bookmark their site and check your inbox (and spam folder) so you can switch autopay without a hitch.

Refinancing: A fresh start for your loans

If Wells Fargo's exit from student loans caught you off guard, no worries! There are plenty of other great private loan companies ready to step up.

Even if you have bad credit, there are still options available. Finding a loan that fits your budget, and possibly reduces the amount of interest you pay is easy.

Check out how to refinance! Many private loan providers are waiting to impress you with great rates and customized terms.

TuitionHero Tip

Refinancing your student loan might get you a better interest rate or a payment plan that fits your budget well.

Firstmark help for former Wells Fargo borrowers

Have questions about your Wells Fargo student loans and the service change? Talk to Firstmark.

Their customer service team is ready to help with your questions and guide you through the changes. Whether online or on a call, Firstmark is here to support you during this transition, making sure you stay in control of your educational investment.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

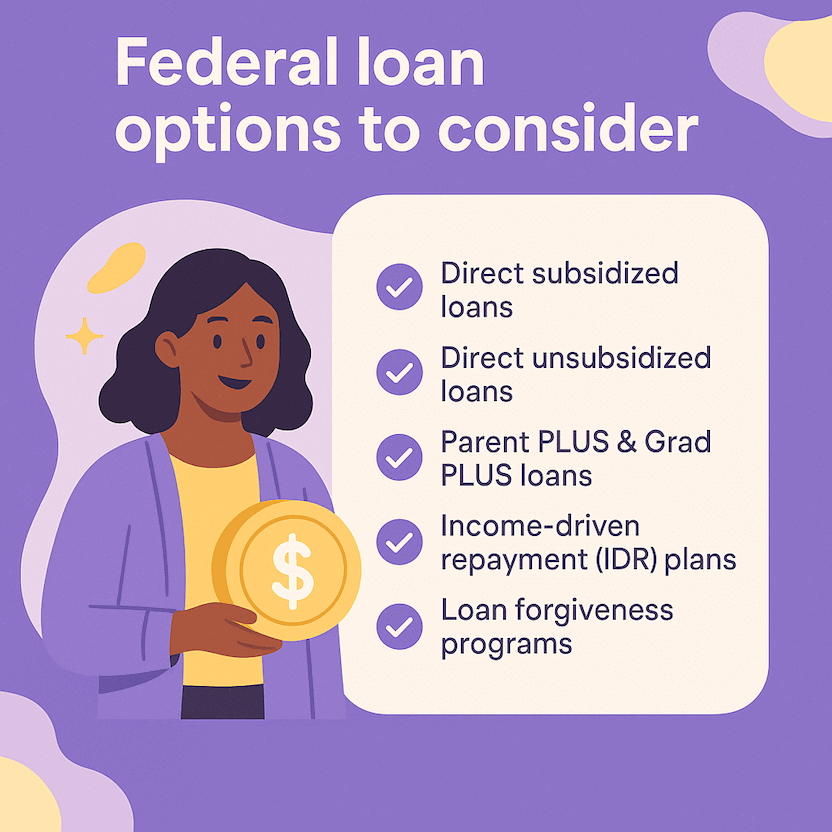

Federal loan options to consider

Even if you started with private financing, federal loans still offer perks you won’t find elsewhere:

- Direct subsidized loans: For undergrads with financial need—no interest accrual while you’re enrolled at least half-time.

- Direct unsubsidized loans: Available to all students; fixed low rates and flexible repayment—even though interest builds while you study.

- Parent PLUS & Grad PLUS loans: Parents and graduate students can borrow up to the full cost of attendance. Remember: these loans are PSLF-eligible once you hit qualifying service.

- Income-driven repayment (IDR) plans: Cap your monthly payment at 10–20% of your discretionary income—and get forgiveness after 20–25 years.

- Loan forgiveness programs: Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness can wipe out your balance if you meet service requirements.

Before opting for a Wells Fargo student loan refinance, see if an IDR plan or forgiveness program fits your goals—in many cases, the benefits outweigh those of a Wells Fargo student loans refinance move.

Ready to apply? Head to FAFSA.gov and explore the Department of Education’s guides to find what fits your goals.

Why trust TuitionHero

We're here to help with private student loans, ensuring you find the right fit for your needs. From navigating Firstmark to exploring refinancing options, we offer expert advice and handy tools. Plus, we make college finances smoother by providing services like scholarships and FAFSA help. If you're considering life after Wells Fargo, we can help with financial aid options and finding compatible credit card offers.

Federal pause on repayment-plan processing

In March 2025, the Trump administration's Department of Education directed all federal loan servicers—including Nelnet/Firstmark—to stop accepting and processing new IDR and consolidation applications for at least three months.

This hold affects millions of federal borrowers seeking income-based plans, potentially delaying relief for those struggling to make payments.

Frequently asked questions (FAQ)

At TuitionHero, we offer resources to help you understand your new arrangement with Firstmark and evaluate whether refinancing could be a good move for you. Check out our Student Loan Refinancing Guide for insights on how to secure a loan that aligns with your personal financial goals.

TuitionHero offers tools and services to compare rates from many lenders, helping you make sure you make an informed decision about your student loan refinancing or new loan options. Visit our private student loan guide for comprehensive information on comparing loan rates and finding the best option for your needs.

Yes, TuitionHero provides access to a wide range of scholarship opportunities. Our scholarship support services are designed to help you discover more funding options that can reduce the need for loans and ease your financial burden.

Wells Fargo sold its entire private student-loan portfolio in December 2020, and Firstmark Services, a division of Nelnet, assumed responsibility for servicing those loans upon the sale.

Yes. Wells Fargo provides a Student Checking Account (sometimes called Teen or Clear Access Banking) designed for ages 13–24. It carries no monthly fee for 17- to 24-year-olds and includes access to 13,000+ ATMs, mobile banking, and optional overdraft protection.

Final thoughts

Transitioning from Wells Fargo to Firstmark under Nelnet doesn’t have to be stressful. By gathering your details, pausing old autopay, verifying contacts, and watching for notices, you’ll be ready for the switch.

And if you need to refinance student loans Wells Fargo, federal programs can offer lower rates, flexible plans, and even forgiveness. Alternatively, if a Wells Fargo refinance student loans option fits your budget, you’ll enjoy customizable terms and potential cost savings. Take control of your repayment strategy today—your future self will thank you.

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today