Advertiser Disclosure

Last update: June 11, 2025

9 minutes read

What Is College Entrance Counseling? Beginner's Guide

Discover the true entrance counseling meaning and learn how each module helps you estimate costs, explore funding options, understand loan terms, and prepare for repayment.

By Derick Rodriguez, Associate Editor

Edited by Yerain Abreu, M.S.

Learn more about our editorial standards

By Derick Rodriguez, Associate Editor

Edited by Yerain Abreu, M.S.

Learn more about our editorial standards

Starting college is exciting—but also financially overwhelming. One of the most important steps in preparing for the cost of higher education is college entrance counseling. Required for federal student loan borrowers, this short online course helps you understand the real cost of borrowing and how to manage it effectively.

This guide will explain what is entrance counseling, who it applies to, what topics are covered, and why it’s more than just a box to check. Whether you're planning to borrow for the first time or getting ready for graduate school, this information is key to managing your financial future. If you're thinking about your future finances, looking into ways to refinance your current student loans can help make your repayments more manageable.

Key takeaways

- Entrance counseling is mandatory for first-time federal student loan borrowers

- It equips students with financial management skills, from budgeting to understanding loan repayment options

- Completion is a one-time requirement per educational level unless transitioning from undergraduate to graduate loans

What is college entrance counseling?

College entrance counseling is an essential step for prospective college students, particularly those applying for federal student loans for the first time. It’s a 30-minute online workshop designed to help you understand how student loans work, covering everything from repayment options to how to manage your finances effectively while in school.

It's a fundamental part of your college preparation. At its core, entrance counseling equips you with the knowledge you need to make informed decisions about borrowing and repaying student loans.

You'll cover key areas like budgeting, building credit, understanding loan terms, and the implications of loan interest and default. Plus, it's an opportunity to learn about federal repayment plans, which could affect your financial strategy post-graduation.

You can complete your entrance counseling through StudentAid.gov, ensuring you're well-informed before your loans are disbursed. Here's what you need to know:

- How federal student loans work

- Many repayment plans and finding one that suits your needs

- Budgeting for your education costs

- The effect of interest on your student loans over time

TuitionHero Tip

This process doesn’t just prepare you for the financial aspects of college life but also provides a foundation for solid money management skills that will help you well beyond graduation.

When is student loan counseling required?

Before diving into the specifics of loan counseling, it’s important to understand when this process becomes a requirement for students. If you're a first-time borrower of federal student loans, student loan entrance counseling isn't just recommended—it's mandatory.

This requirement is in place to make sure you fully understand the details and responsibilities that come with accepting federal student loans. For undergraduate students eyeing their first Direct subsidized or unsubsidized loan, this process is a one-time requirement.

Graduate students entering Grad PLUS loans will have to go through entrance counseling again, even if they did it before for undergraduate loans. Parents taking out a PLUS loan for their child usually don't have to do this unless they have a bad credit history.

What are the benefits of student loan counseling?

Student loan counseling is a powerhouse of information that prepares you not just for the years during college, but for financial well-being long after graduation.

- Improves understanding of loans: It explains the terms, conditions, and responsibilities associated with borrowing.

- Prepares for financial management in college and beyond: Offers essential lessons in budgeting and credit building.

- Informs about repayment plans: Helps in making informed decisions about the best repayment strategy post-graduation.

- A measure against delinquency and default: Teaches about the consequences of missing payments and how to prevent them.

- Makes informed borrowing decisions easier: By understanding the total cost of education, borrowers can make strategic borrowing decisions.

What happens if you need to redo or update entrance counseling?

In some cases, students might wonder about redoing or updating their entrance counseling. It's rare, but situations can happen where a refresher or update is necessary.

However, for most students, once you've completed entrance counseling for your current degree level, there's no need to go through the process again unless you transition to a new level of education, like moving from undergraduate to graduate studies.

If there are any updates to your financial situation or federal regulations, staying informed through your school's financial aid office and resources like TuitionHero.org is a smart move.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Dos and don'ts of completing student loan entrance counseling

Student loan entrance counseling might seem confusing, but we want to make it easier for you. To help, we'll tell you what to do to make the most of it and what to avoid. This advice is here to make your counseling session straightforward and helpful.

Do

Do prepare your necessary documents in advance.

Do set aside uninterrupted time to complete the process.

Do actively engage with the content and take notes.

Do use the resources provided to plan your financial future.

Do check with your financial aid office if you have any questions post-counseling.

Don't

Don't rush through the modules.

Don't skip over sections you think aren't relevant.

Don't hesitate to ask for clarity on confusing topics.

Don't ignore your budgeting and credit-building lessons.

Don't forget to update your school if your financial situation changes.

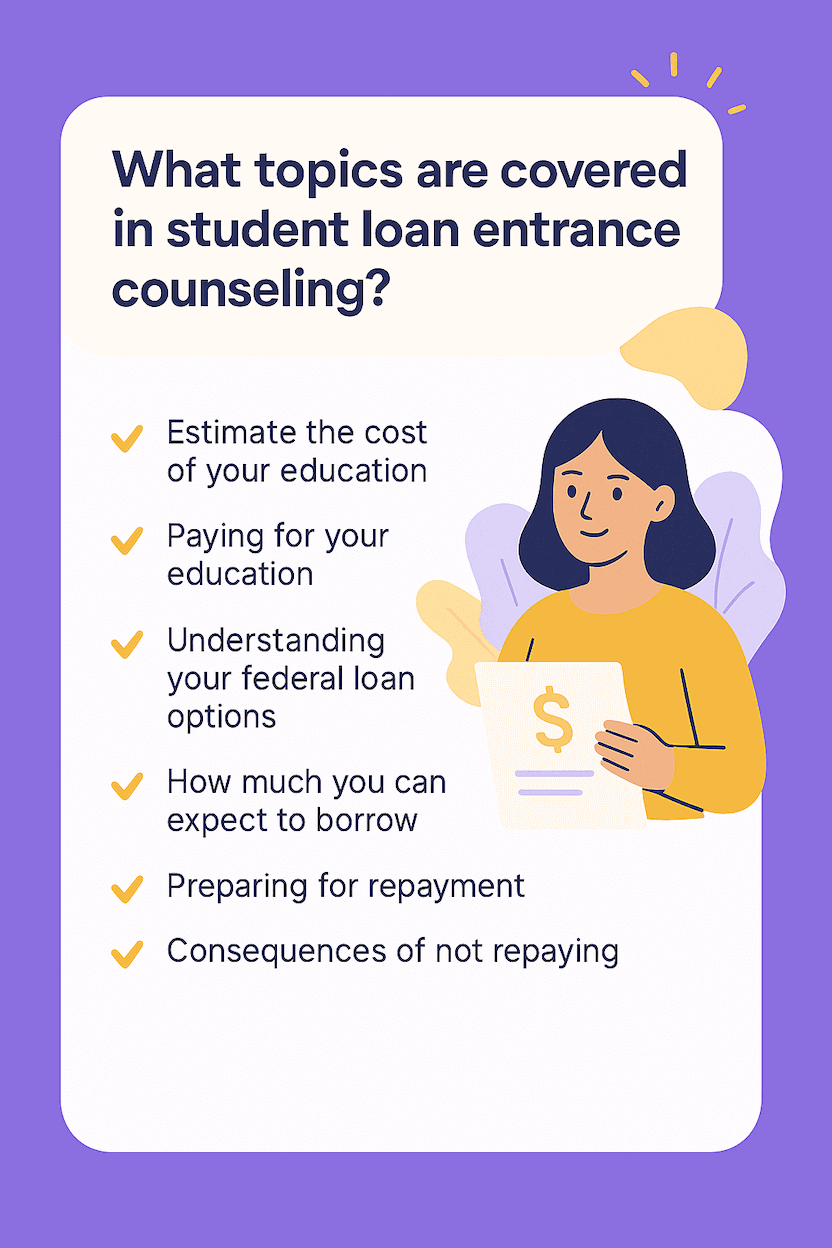

What topics are covered in student loan entrance counseling?

College entrance counseling isn't just a formality—it's a crash course in how to responsibly borrow and repay your loans.

The session is divided into six modules, each designed to give you a better handle on your finances during and after college. If you’ve ever wondered what is entrance counseling, this breakdown will walk you through everything the course covers.

Here’s what you’ll learn:

1. Estimate the cost of your education

This module teaches you to calculate your school's total cost of attendance, including tuition, books, housing, and personal expenses. It helps you plan ahead and consider how much you truly need to borrow.

2. Paying for your education

Before tapping into loans, you'll learn to prioritize scholarships, grants, and work-study. Understanding these alternatives is essential to reduce your loan burden—this is the heart of student loan counseling.

3. Understanding your federal loan options

In this step, you’ll explore the types of federal student loans available, like Direct Subsidized and Unsubsidized Loans, and how the application process works.

It introduces you to the entrance counseling definition, including your responsibilities as a borrower and the loan terms you're agreeing to through the Master Promissory Note.

4. How much you can expect to borrow

You'll plug in your own cost of attendance to estimate how much you may need over your college career. This section is key to answering the question: how might entrance counseling help a first time borrower?

The course encourages borrowing only what you need—and shows how even small payments during school can reduce your overall interest.

5. Preparing for repayment

This module lays out what to expect after graduation: repayment plans, grace periods, and how interest accrues. You'll learn smart strategies that make entrance counseling a valuable tool not just before school, but long after.

6. Consequences of not repaying

Defaulting on your loan has serious consequences, including credit damage and wage garnishment. This module is a reminder that entrance counseling meaning extends to understanding the long-term impacts of borrowing and managing debt responsibly.

TuitionHero Tip

If you’re wondering how long is entrance counseling good for, the answer is typically one time per degree level. However, if you’re transitioning from undergraduate to graduate school, you’ll need to complete it again.

Recent update: federal student loan collections resume

As of May 5, 2025, the U.S. Department of Education will resume collections on defaulted federal student loans, ending a pause that began in March 2020 due to the COVID-19 pandemic.

This action affects approximately 5.3 million borrowers who have not made payments in over 270 days, placing them at risk of involuntary collection methods like wage garnishment, tax refund offsets, and Social Security benefit reductions.

Borrowers are encouraged to contact their loan servicers promptly to explore options like income-driven repayment plans or loan rehabilitation programs to avoid these severe consequences.

This development underscores the importance of understanding the terms and responsibilities associated with federal student loans. Entrance counseling plays a crucial role in educating borrowers about these obligations, helping them make informed decisions and avoid the serious consequences of loan default.

Why trust TuitionHero

At TuitionHero, we simplify college finances. We provide resources to learn about federal student loans and scholarships. Our platform connects you with lenders for private student loans and refinancing. We offer tools to understand entrance counseling requirements.

Frequently asked questions (FAQ)

Entrance counseling is important for federal student loan borrowers, but it can also be helpful for those thinking about private student loans. The basic ideas about managing loans, budgeting, and financial planning shared during counseling apply to everyone. This information helps students make smart choices, no matter where their loans come from.

If you switch to a different school after finishing entrance counseling, your new school should be able to check if you completed counseling through the Department of Education's systems. But, it's important to double-check with your new school's financial aid office to make sure everything is in order and there won't be any problems getting your loan funds on time.

Yes, TuitionHero helps students and parents with education. If you're deciding about your child's education or thinking of going back to school, we can help.

Our resources can help you find scholarships, understand FAFSA, and choose the right loans for students or parents. We're here to support you with the financial side of education.

Entrance counseling typically takes 20 to 30 minutes to complete. It must be done in one sitting and includes six interactive modules covering everything from estimating college costs to understanding repayment strategies.

Once finished, the requirement is fulfilled for your current education level—though you’ll need to complete it again if you pursue a higher degree, like moving from undergraduate to graduate school.

Federal student loans typically go into default after 270 days (approximately nine months) of non-payment. During this period of delinquency, borrowers are expected to bring the account current or contact their loan servicer to discuss repayment options like deferment, forbearance, or an income-driven plan.

Ignoring the problem can lead to default, which triggers serious consequences like credit damage, wage garnishment, and loss of future federal aid eligibility.

Exit counseling is a mandatory process for federal student loan borrowers who are graduating, leaving school, or dropping below half-time enrollment.

It helps prepare you for loan repayment by reviewing your current loan balance, estimated monthly payments, interest rates, and available repayment plans. It also explains how to avoid delinquency or default and what to do if you're facing financial challenges after school.

Final thoughts

Now that you understand the core purpose and content of entrance counseling, you’re better equipped to borrow smart and prepare for repayment. Whether you’re evaluating your loan options or creating a long-term budget, this process is a valuable resource—especially for first-time borrowers.

At TuitionHero, we’re here to help you make the most of your college experience with smart borrowing tips, refinancing options, and tools to compare loans. Bookmark this guide and explore more on our site to stay informed. When it comes to student loans, knowledge really is power.

Source

Author

Derick Rodriguez

Derick Rodriguez is a seasoned editor and digital marketing strategist specializing in demystifying college finance. With over half a decade of experience in the digital realm, Derick has honed a unique skill set that bridges the gap between complex financial concepts and accessible, user-friendly communication. His approach is deeply rooted in leveraging personal experiences and insights to illuminate the nuances of college finance, making it more approachable for students and families.

Editor

Yerain Abreu

Yerain Abreu is a Content Strategist with over 7 years of experience. He earned a Master's degree in digital marketing from Zicklin School of Business. He focuses on college finance, a niche carved out of his journey through the complexities of academic finance. These firsthand experiences provide him with a unique perspective, enabling him to create content that's informative and relatable to students and their families grappling with the intricacies of college financing.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today